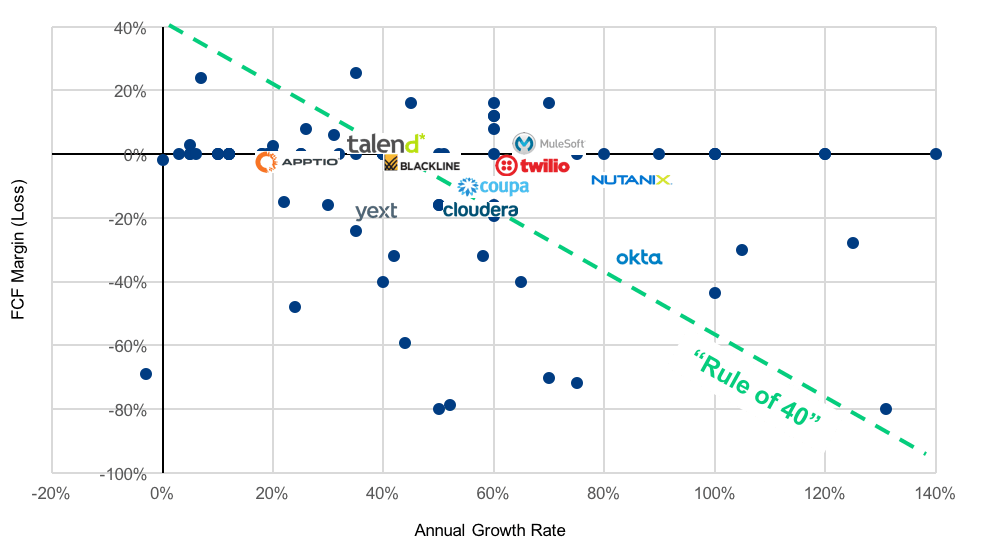

Earlier this summer, we surveyed 300 enterprise software companies ranging from pre-revenue to more than $20 million in ARR and across every software category. The point of this survey was to gain a better understanding of how software companies are performing as a whole, and to help companies understand how they measure up against their peers – and not just a handful of well-known unicorns.

With our findings, we aim to reframe the conversation of how the tech ecosystem defines success in a growing software business. Success shouldn’t only be defined by an IPO in five years. Success means building a sustainable and enduring business that improves the lives of its employees, customers and shareholders alike.

Special Thanks to Our Partners