Software buying has evolved. The days of executives choosing software for their employees based on IT compatibility or KPIs are gone. Employees now tell their boss what to buy. This is why we’re seeing more and more SaaS companies — Datadog, Twilio, AWS, Snowflake and Stripe, to name a few — find success with a usage-based pricing model.

The usage-based model allows a customer to start at a low cost, while still preserving the ability to monetize a customer over time.

The usage-based model allows a customer to start at a low cost, minimizing friction to getting started while still preserving the ability to monetize a customer over time because the price is directly tied with the value a customer receives. Not limiting the number of users who can access the software, customers are able to find new use cases — which leads to more long-term success and higher lifetime value.

While we aren’t going 100% usage-based overnight, looking at some of the megatrends in software — automation, AI and APIs — the value of a product normally doesn’t scale with more logins. Usage-based pricing will be the key to successful monetization in the future. Here are four top tips to help companies scale to $100+ million ARR with this model.

1. Land-and-expand is real

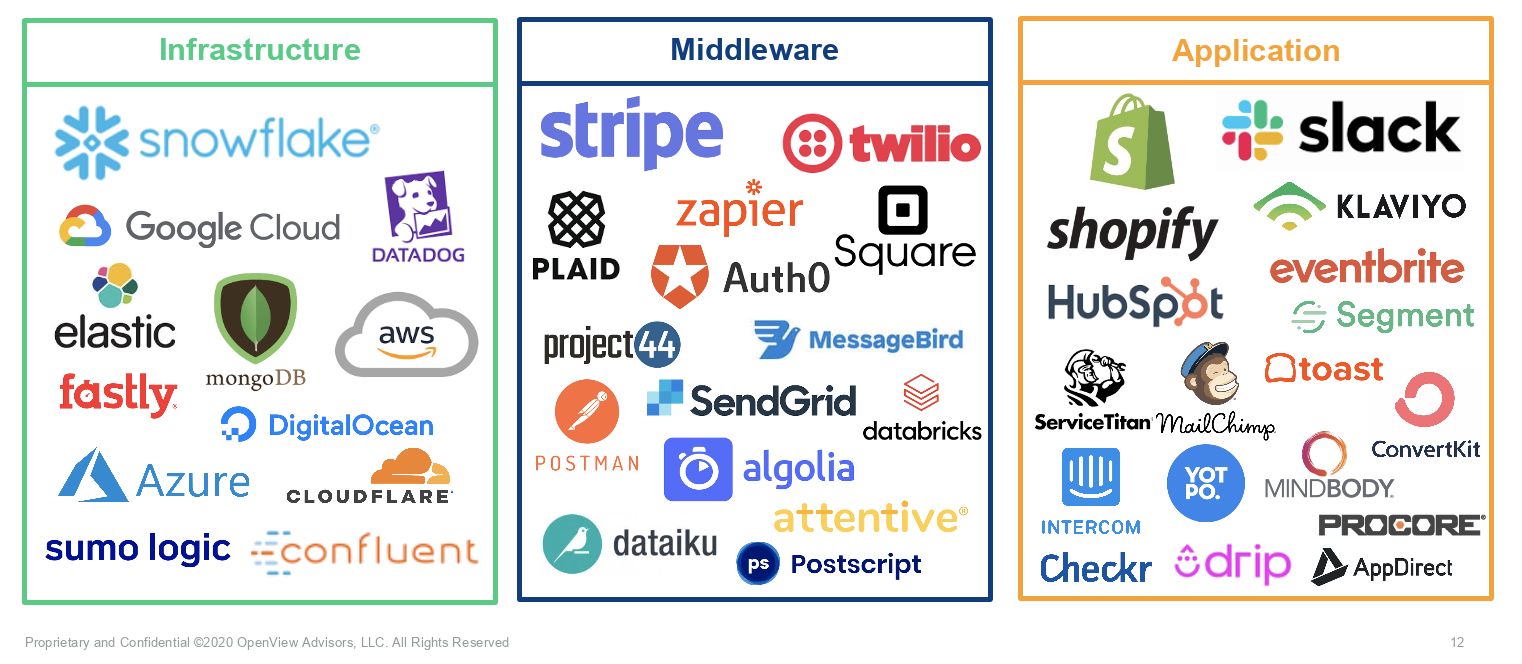

Usage-based pricing is in all layers of the tech stack. Though it was pioneered in the infrastructure layer (think: AWS and Azure), it’s becoming increasingly popular for API-based products and application software — across infrastructure, middleware and applications.

Image Credits: Kyle Poyar / OpenView

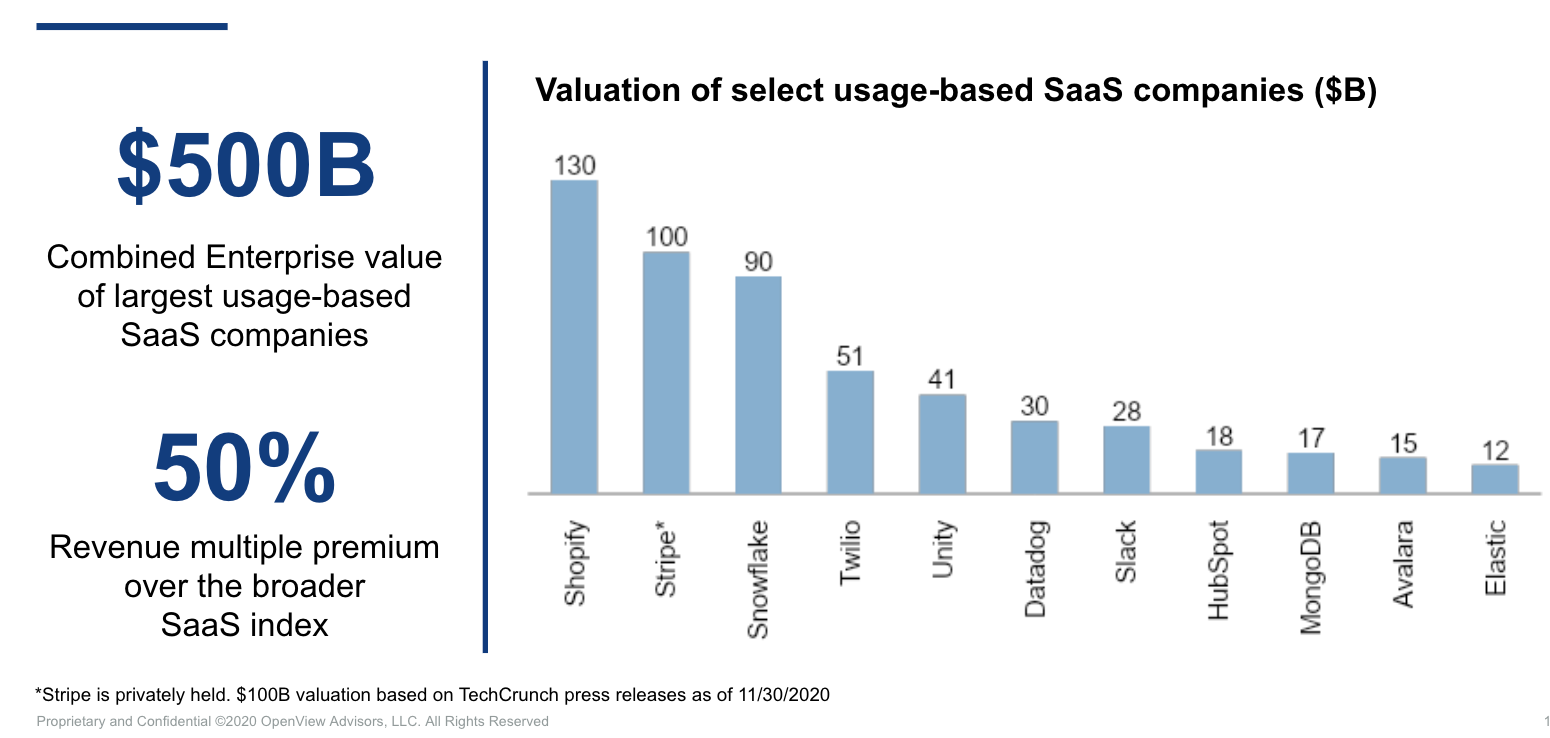

Some fear that investors will hate usage-based pricing because customers aren’t locked into a subscription. But, investors actually see it as a sign that customers are seeing value from a product and there’s no shelf-ware.

In fact, investors are increasingly rewarding usage-based companies in the market. Usage-based companies are trading at a 50% revenue multiple premium over their peers.

Investors especially love how the usage-based pricing model pairs with the land-and-expand business model. And of the IPOs over the last three years, seven of the nine that had the best net dollar retention all have a usage-based model. Snowflake in particular is off the charts with a 158% net dollar retention.

Image Credits: Kyle Poyar / OpenView

2. Pick the right usage metric

Having a usage-based pricing model presents unique go-to-market and operational challenges. Think carefully about the usage-based value metric, which is the primary unit that determines how much a customer pays. There are many metrics you could use in your pricing — it could be based on customer size, usage, users or another criteria.

Make sure the one you choose grows consistently across your customers, helps you communicate your product’s value and can be predictable for your customers. Keep in mind five core requirements: value-based, flexible, scalable, predictable and feasible.

A few examples of the many potential usage metrics you could use in your pricing from real companies: Attentive, a personalized text messaging platform, uses the number of SMS messages. Data platform Snowflake uses compute resources and volume of data. Datadog, a monitoring and security platform for cloud applications, uses the number of hosts (infrastructure monitoring) and amount of ingested or scanned GB (log management.)

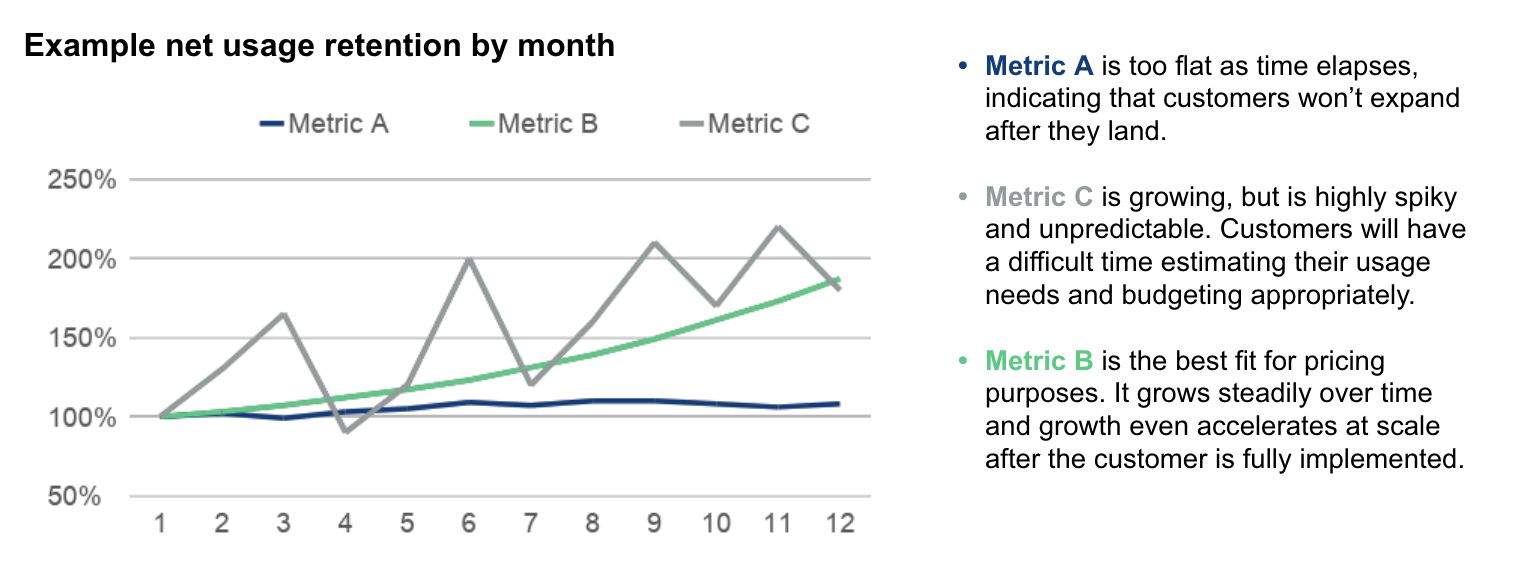

For many successful startups, usage grows steadily over time for the average customer. However, certain metrics are a good and bad fit for pricing purposes.

Image Credits: Kyle Poyar / OpenView

3. Pay reps beyond the first commitment

The usage-based customer journey often looks different from traditional software. You want to use product-led growth to reduce friction in customers getting started. Then, after customers are successful, sales come in to generate committed contracts.

Customer success also has a really important role in driving usage and stickiness over time. Make sure sales compensation doesn’t get in the way — and doesn’t create the wrong incentives for your team. Most usage-based companies, for instance, let their reps share in the upside if a customer expands their usage after the initial subscription. This allows the reps to focus on getting that initial subscription quickly and with the usage that is the right amount a customer needs. If that customer winds up being successful, it’s a win-win.

Reps need to be closing deals quickly and then letting usage grow over time. Make sure to include a tail based on actual usage after ramp.

4. You can’t predict your best customers

Consumption-based revenue isn’t as predictable as subscription-based revenue. This means you’ll want to invest significantly in tooling and people to be able to predict your customers’ consumption.

You’ll be making a bunch of bets — and some of those bets will pay off spectacularly. If revenue is consumption-based, you have to invest heavily in prediction consumption. So keep in-mind: IPO-ready FP&A teams treat forecasting as a data science exercise. Teams are digging into valuable revenue signals on the cohort and customer level.

The bottom line: Invest in a great experience for all signups regardless of their initial spend.

Ready to scale to $100+ million ARR?

Today, even traditional subscription companies are incorporating a usage-element in their pricing — such as Salesforce, Box and Zoom. Top SaaS companies like Datadog, Twilio, AWS, Snowflake and Stripe have already succeeded with this next evolution in software pricing.

For your business, start by evaluating whether a usage model is right for your product. Each use should generate a positive business outcome for customers as you share in their success. And if this model is a good fit, be sure to pick the right usage metric — take time with this decision and be flexible to change it as you scale. Finally, be prepared to build. From billing to sales compensation, many companies had to build custom solutions to the operational challenges around their specific usage model.