WHAT IS USAGE-BASED PRICING?

Usage-based pricing, explained

With usage-based pricing, a customer can start using a product for a comparatively low cost. This lowered barrier to entry attracts more customers to get started and allows for a subset of customers to grow their usage rapidly.

A key differentiator for UBP versus other pricing models is that you aren’t limiting the number of users who have access to your software. This drives customers to discover new use cases, leading to long-term success and a higher customer lifetime value.

Usage-based pricing: How we got here

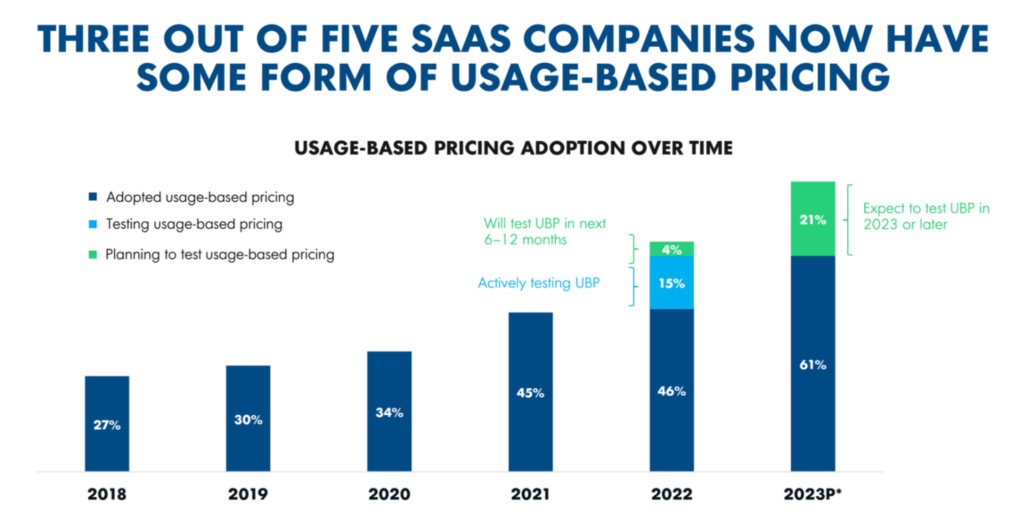

With adoption nearly doubling within B2B SaaS in the past five years, it’s fair to say usage-based pricing models have become normalized. Today, three out of five companies are now using some form of UBP—either fully adopting or actively testing it—leaving us wondering: how did we get here?

Much of the purchasing power for enterprise SaaS has been transferred to the end user. These people sit within business or engineering teams and expect to realize value from your product before pulling out a credit card. Usage- or consumption-based billing in SaaS addresses this change in buying behaviors by allowing users to start for little to no cost and pay later as usage grows.

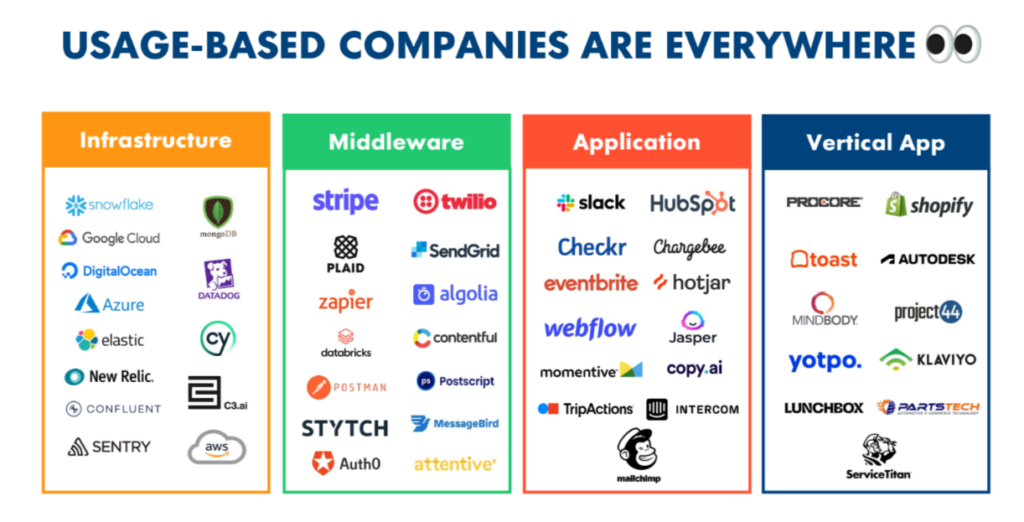

The usage-based pricing model was originally pioneered in the infrastructure layer (e.g. AWS and Azure) but has since become popular throughout the software world. In fact, today’s software trends all but mandate charging on usage—not users. The technologies that are driving innovation in the SaaS world are often best suited for usage-based models:

- Automation: Software increasingly automates manual processes. The more successful a product is, the fewer user seats a customer needs. Seat pricing doesn’t scale with the value of automation.

- AI: AI takes automation a step further, eventually eliminating the need for whole teams of people for ongoing tasks. Monetization can no longer be tied only to human users of a product.

- API: For many of the fastest-growing software companies, the value is in the API—software talking directly to other software—rather than the UI. There doesn’t need to be a user to see value.

Benefits of going usage-based

Pricing strategy selection is a critical choice. Your decision will impact business priorities, and product decisions—not to mention revenue generation. Believe it or not, following the usage-based pricing playbook might just be what your business needs to scale to $100+ million ARR.

Core to UBP strategy is the principle that you can’t predict your largest accounts. When you implement UBP, you’re making a bunch of bets with the hope that some of them will pay off spectacularly. Seeing this return requires building a great experience for all users who sign up—regardless of their initial spend.

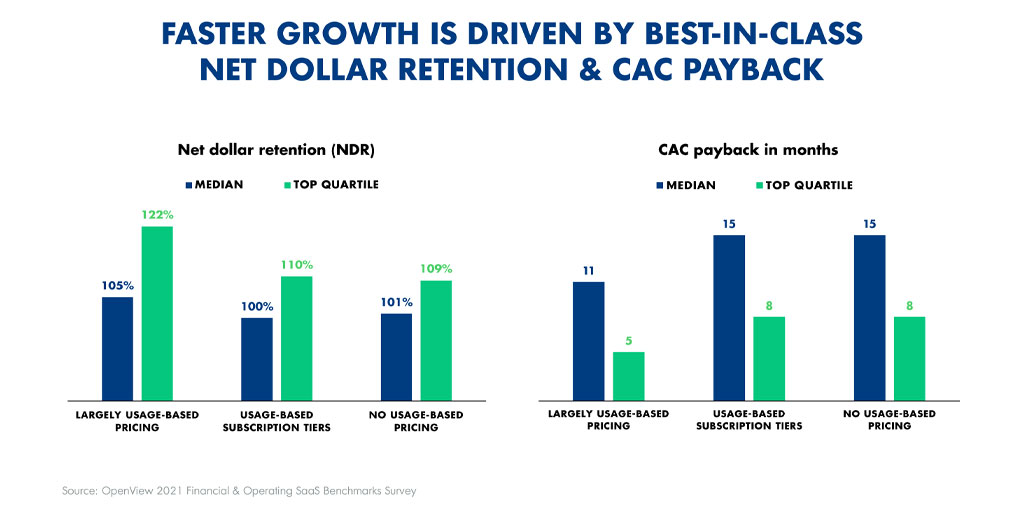

Why do SaaS companies with usage-based pricing grow faster? Attribute it to superior CAC payback and net dollar retention rates—it’s no surprise that usage-based pricing is on the rise.

The various benefits of UBP demonstrate why this strategy is being rapidly adopted across the SaaS market:

- It allows the customer to start at a low cost, minimizing friction to adoption. The best way to win customers in the end-user era is to deliver value rapidly and for little to no cost. Proving this value at the outset is central to a strong product-led GTM strategy.

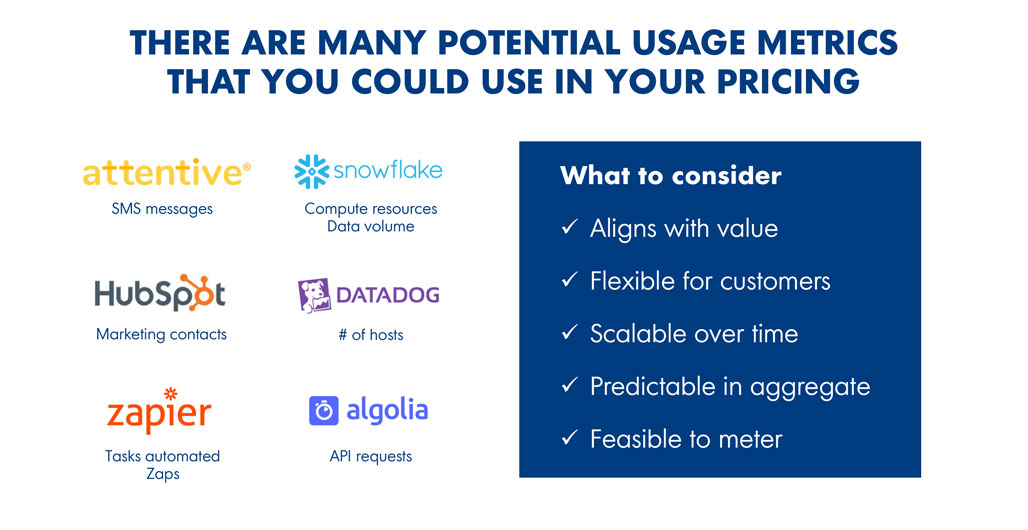

- It directly links the price paid with the value received. Picking the right value metric on which you base your UBP model allows your business to measure growth consistently across your customers, communicate your product’s value, and be (somewhat) predictable. Do this correctly and usage-based pricing becomes synonymous with value-based pricing.

- It allows more users to access a product within an account, making the software more ubiquitous and seeding new use cases. The UBP framework promotes a land-and-expand strategy. Abandoning seat-based software pricing models encourages more people within a customer account to incorporate your product into their workflows and processes. And when one group of users experiences success, it increases the likelihood that they share their experiences with other potential users within their companies or even with outside organizations.

- It expands your total addressable market (TAM) by making the product more accessible while uncapping the potential upside. UBP businesses reap the benefit of expanding to customers outside of their ideal customer profile without requiring additional effort from marketing and sales. TAM expansion is highly profitable and can inform the development of new features or your go-to-market strategy.

The rise of hybrid pricing models

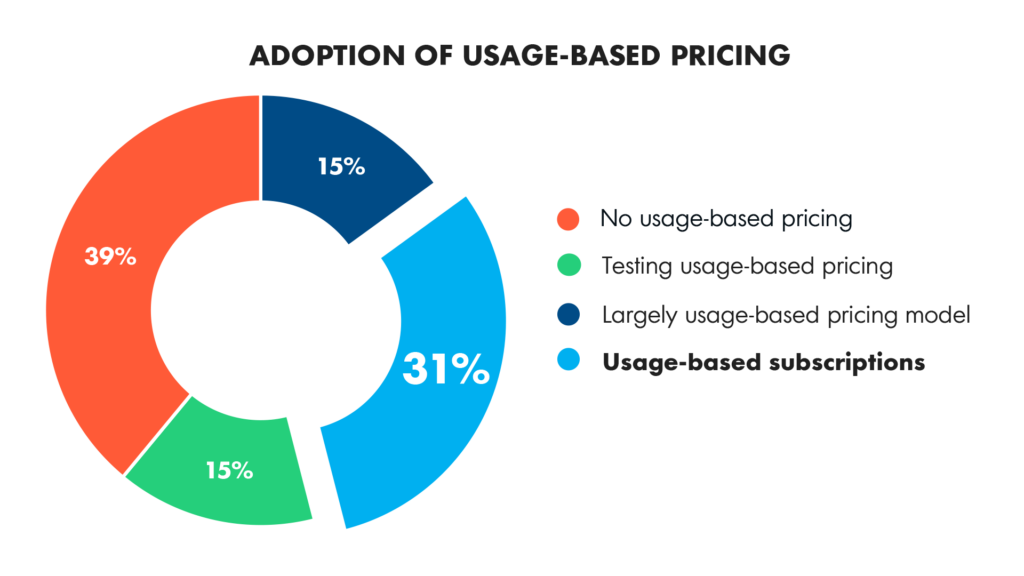

Not all companies are building usage-based models in the same way. In fact, recent data shows that hybrid models are winning. Hybrid pricing models—which include usage-based subscriptions or UBP alongside traditional subscriptions—help companies win deals and meet customers where they are.

While 15% of SaaS companies have rolled out a largely usage-based or pay-as-you-go model, three times as many companies (46%) take a hybrid approach, either by testing UBP alongside traditional subscriptions or offering a usage-based subscription plan.

Observing usage-based models in the wild

We’re seeing usage-based and hybrid models spring up in every corner of the software industry. While usage-based models have become the norm in infrastructure (ex: AWS, Azure, GCP), they’re now found or being tested in all layers of the tech stack, including horizontal and vertical applications.

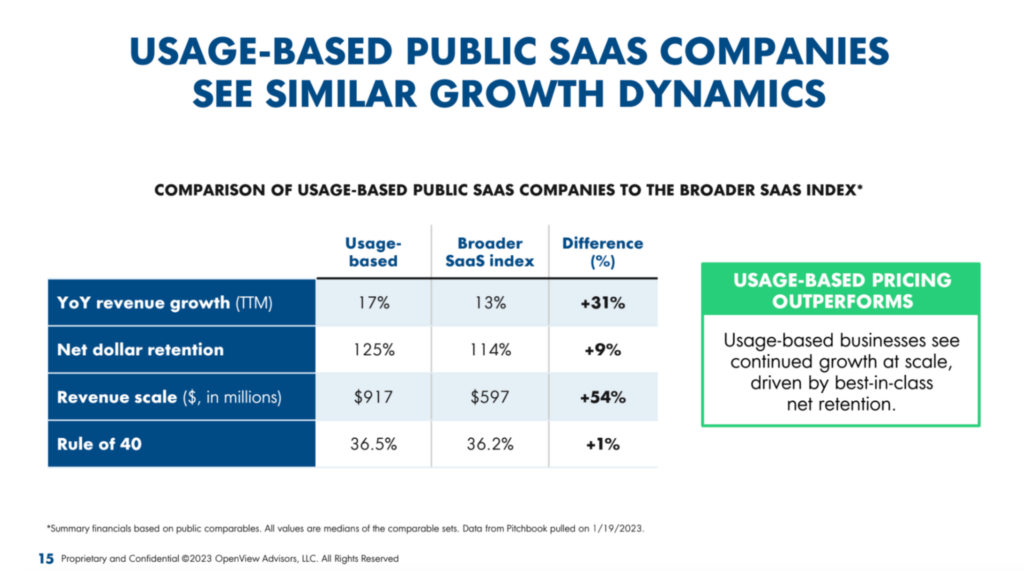

Not only are usage-based companies on the rise, they’re high-performing as well. Usage-based public SaaS companies see continued growth at scale—+54% revenue scale compared to the broader SaaS index—driven by best-in-class net retention.

Implementing UBP as part of a company-wide PLG strategy

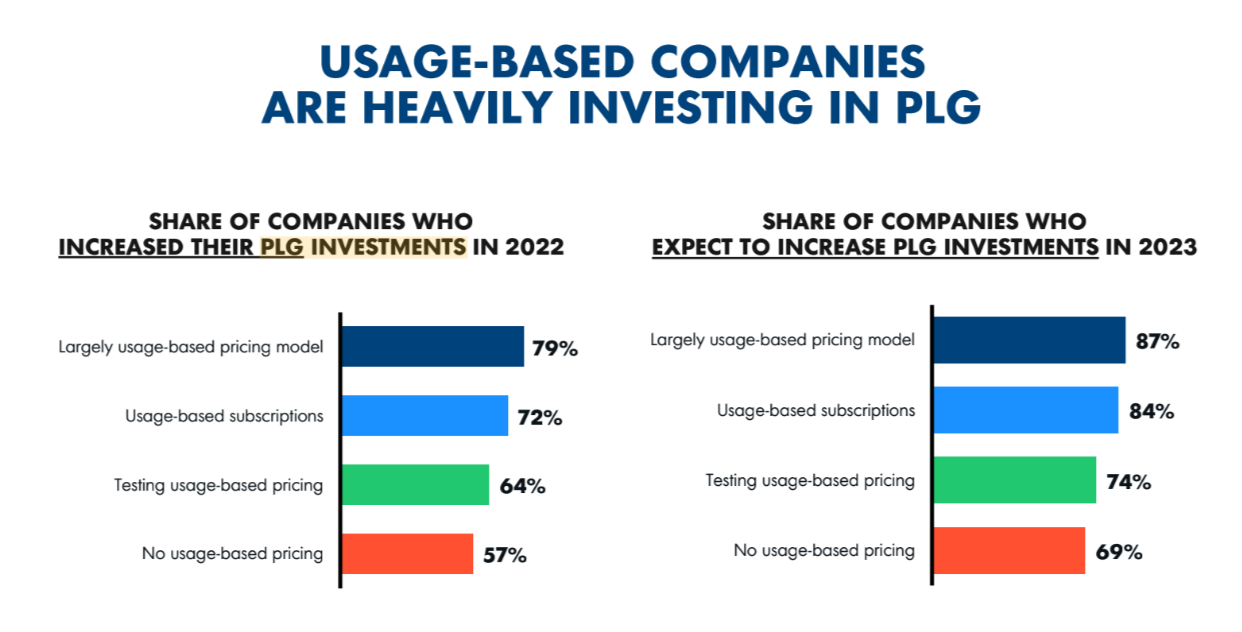

Usage-based pricing is more than a pricing strategy—it’s a company-wide mindset. Top usage-based SaaS companies tend to be the most customer-focused companies out there, instilling a customer success mindset across every team. In other words, they’re investing heavily in product-led growth.

With usage-based pricing models, customer success is intrinsically tied to revenue—the business only grows when your customers do. That’s why it’s important for every team to play an active role in driving customer adoption.

Here’s how different areas of the business can support a transition to UBP:

Product: Treat product investments as revenue-generating expenses.

With usage-based pricing, revenue growth depends on customers using and seeing value from the product. This means carving out dedicated resources to focus on product adoption. Usage-based SaaS companies spend more on R&D than their sales and marketing peers.

Marketing: Connect marketing efforts with the product and user community.

While product is the tip of the spear, marketing and product marketing are vital for driving product adoption. Marketing teams at top usage-based companies give users the tools and community to be more successful with their products and to discover new ways of finding value.

Sales: Consumption is the holy grail.

With “commitments” no longer the primary goal, usage-based billing companies are more patient to grow account usage over time. Many usage-based sales teams let reps share in the upside when customers consume more than they initially committed by transitioning to a consumption-based sales compensation structure.

Customer success: Be proactive and look for leading indicators of future success.

Post-sale, your CS team takes over to drive customer adoption. They initially focus on driving adoption of key features that create long-term stickiness such as setting up integrations and shared dashboards or working with client teams to identify new use cases.

Finance: Reinvent the traditional SaaS metrics playbook.

Your financial processes and metrics need to be recalibrated with any pricing change. However, UBP can pose a new array of challenges to revenue recognition and forecasting. But rest assured—there is a path to predictable revenue with a usage-based revenue model.

Use usage data to clarify questions like:

- How long does it take to deploy the solution before usage begins?

- What will the ramp-up of usage look like in the initial period (quarter, year)?

- Will this usage be sustainable after initial benefits are realized?

- When will network-effects adoption kick in and how fast?

Usage-based pricing examples: Stories of success

In the past, businesses feared investor dissatisfaction with moving away from subscription models to going usage-based. Today, investors more frequently recognize it as a sign that customers are seeing value from a product. In fact, investors are increasingly rewarding usage-based companies in the market. Public usage-based companies are trading at a 50% revenue multiple premium over their peers.

Investors especially love how the usage-based pricing model pairs with the land-and-expand business model. And of the IPOs over the last three years, seven of the nine that had the best net dollar retention all have a usage-based model.

Learn from the success stories of SaaS usage-based pricing companies who’ve achieved fantastic results:

Algolia

Algolia is an AI-powered search and discovery platform. They redesigned their pricing structure eight times since their founding in 2012. In fact, their earliest model was usage-based, but they turned to feature-gating and a sales-led GTM strategy in later iterations.

In 2019, they decided to revert back to UBP and product-led growth, leaning into the model even harder this time. Their goal was to build a pricing strategy that was truly developer-centric—what they called “the most customer-friendly pricing ever.”

Here’s how they successfully transitioned back to a usage-based model:

- Not pursuing growth at all costs. Algolia learned that pursuing growth at all costs can lead to decisions the business may regret down the road. For them, it meant building a sales-led growth model at the expense of a product-led growth one.

- Taking the time to do UBP right. Their transition to their new pricing model took a little under a year. With so much to do—from changing the service order, billing system, pricing page, and training the support and sales teams—this was time well spent.

- Instilling a PLG mindset throughout the company. When the business’s goal becomes maximizing the product experience, everyone in the company needs to adjust the way they approach their work. To make this shift, you might need external people who can progressively challenge the mindset of your internal teams.

Datadog

Datadog is a monitoring platform for cloud-scale applications whose Series B OpenView led in 2014. Usage-based pricing has been part of Datadog’s DNA since the beginning. Datadog’s former VP finance, Scott Buxton, attributes much of the company’s market success to the way usage-based pricing removed friction for adoption. Getting started with their product was easy for customers, and an emphasis on flexible usage made staying with Datadog a no-brainer.

Scott shares his experience and guidance for financial teams at companies that are implementing usage-based pricing:

- Emphasizing the benefits of UBP to get investors excited about usage-based metrics. Despite challenges around forecasting and predictability, forward-thinking investors see usage-based pricing as a highlight. For those who are hesitant, frame usage-based metrics as an opportunity to measure product adoption, performance, and virality.

- Automating financial processes when it’s time to scale. Don’t let your financial teams get too bogged down with manually creating, tracking, and accounting for usage-based quotes. When a company reaches a certain size, the investment in automating these processes quickly becomes worth it.

- Encouraging finance to collaborate with outside teams. Oftentimes, finance teams are the last to know about upcoming changes. Product, sales, and CS teams can all help the finance department prepare for changes proactively and do their job better.

Datadog implemented a drawdown model option that allows customers to adapt their usage pace according to the needs of their business. This helps to balance the business’s need for predictability with the customer’s need for flexibility. – Scott Buxton, former VP of Finance, Datadog

Cypress

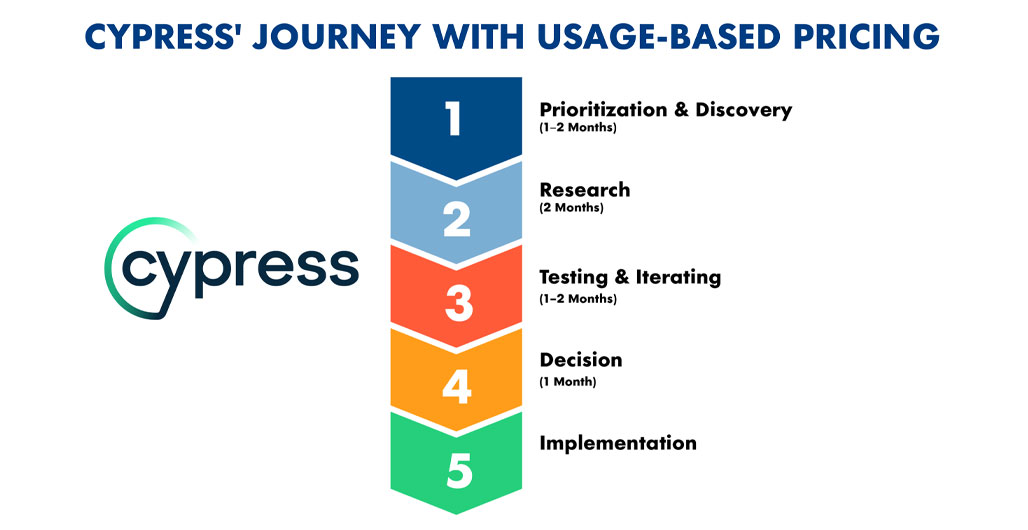

A user-friendly test automation tool and OpenView portfolio company, Cypress launched usage-based pricing in 2021 to address how testing was becoming more collaborative at many companies.

As a product-led company, Cypress used feedback as their primary decision-driver. Here’s how they leveraged feedback, along with other strategies, to launch their new pricing model:

- Asking for customer feedback about pricing, not just product. It’s important to understand the customer’s perceived value and willingness to pay. Their feedback creates urgency for undergoing a change and can lead to new ideas you might not have considered.

- Making sure the pricing initiative is an OKR-level priority. Successful implementation of UBP requires buy-in from leaders and departments across the org. The process requires a significant lift from multiple teams—even when leveraging a third party.

- Being unafraid of (healthy) debates. Pricing is an inherently cross-functional topic in SaaS. Encourage teams to express their unique viewpoints. Their insight is valuable. Take the time to align around a shared set of data points and then discuss the pros/cons of each pricing option as a group.

New Relic

New Relic, the cloud observability company, spent most of 2020 reinventing itself after a stock price plunge. Among the changes to their business and product was the shift from subscriptions to a new usage-based pricing model—making them the first (if not the only) public SaaS company to make the switch to UBP in the public eye.

The impact of going usage-based has been well worth the investment so far. It has led to a reacceleration in the company’s account growth as well as data ingestion (the process of transporting data from one or more sources to a target site for processing and analysis), two leading indicators of future success. Here’s how they navigated their pricing model transition with flying colors:

- Designing a new sales process for a usage-based model. For New Relic, this meant paying sales reps on consumption, not commitment. Consumption-based compensation encourages reps to work closely with customers to drive awareness, find new use cases, and introduce new features.

- Combining usage-based pricing with a product-led growth engine. This combination can generate powerful results. Consider using in-product experiments to drive greater discovery and adoption.

- Committing to a change management plan. Change is always tough, particularly for existing customers who may resist being migrated to the new pricing. Being accommodating to current customers when rolling out usage-based pricing is important for retention.

“What we have been surprised to see is that some of our largest customers have said, ‘We really don’t want to commit to anything and are comfortable paying rack rate,’” –Peter Goldmacher, New Relic’s VP of Investor Relations

Landbot

When Landbot, a no-code chatbot builder, introduced a usage-based pricing model, they saw a 26% increase in net revenue retention. Previously, Landbot based their pricing solely on feature tiers and seats. This meant that customers generating 10 chats a month and customers generating 100k chats a month had the same bill. As they closed their Series A, they identified usage-based pricing as a potential opportunity and began to experiment.

Preceding their transition, Landbot invested in research up-front across three sprints. The team designed research plans, collected and analyzed data, and discussed results over the course of two to three weeks per sprint. They conducted pricing research mainly with an external audience who fit their buyer persona. This was to avoid risking bias from surveying existing customers, who might not have the incentive to be honest.

Here’s where they focused:

- Validating the buyer persona. Despite their confidence in knowing who their ideal customer is, they wanted to reach a quantitative understanding of who was using their product. They looked at internal data and results of a price sensitivity survey to create a set of firmographic and demographic attributes of their ideal and secondary customer segments.

- Determining feature packaging and value metrics. Before deciding whether or not to keep feature tiers, the Landbot team wanted to find out if they could refine which features would go into each tier. They also sourced opinions on how the product pricing should scale. They surveyed the panel and then used the insights to categorize each feature as a differentiator, table stakes, add-on, or trash.

- Nailing price points with another price sensitivity survey. They presented the research panel with detailed feature tiers informed by findings from the previous sprints. They asked the panel about their potential usage volume and analyzed the results to determine the optimal price range for each tier.

“Pricing changes are always risky, but the risk-to-reward ratio of usage-based pricing is asymmetric – which is likely what makes monetization the most effective growth pillar.” – Austin Yang, Former Lead Product Manager at Landbot

A step-by-step guide to navigating a usage-based pricing launch

Change is hard, and your customers will likely be hesitant to change the way they pay for your product. With a solid plan in place, however, you’ll be able to migrate existing customers, reduce churn, win prospects, and scale your business with consumption-based pricing.

Step 1: Begin with value

First, help your buyers understand the reason behind the change. Winning them over will take positioning the change as a benefit to them. The good news is that usage-based pricing is extremely customer-friendly.

Your marketing program should emphasize that the usage-based metric that calculates pricing is inherently tied to value. Likewise, your customer success team should be focused on supporting this usage metric as they help customers day-to-day.

Learn more about planning a successful usage-based pricing launch.

Step 2: Craft the right message

More accurately, craft the right messages—one set for existing customers and another for new customers.

When launching UBP to prospective customers, don’t get caught up in trying to land on the perfect message from the get-go. Instead, begin with a set of hypotheses and a system to build predictions. With a comprehensive testing plan, you’ll be able to track outcomes and course-correct until you land on the winning strategy. Try segmenting customers and A/B testing messages to see which ones have the greatest impact.

Learn more about announcing your transition to UBP.

Step 3: Learn, adapt, and win

In each step of the transition process, you’ll be learning how to connect value to price. The final step will be developing the ability to predict usage. This is one of the best investments you can make going into a consumption-based pricing strategy. Not only does it help predict revenue for your business, but it’s valuable information to your customers as well.

Find out how you can predict usage and stay on top of UBP trends to win with usage-based pricing.

Supporting usage-based pricing with the modern pricing tech stack

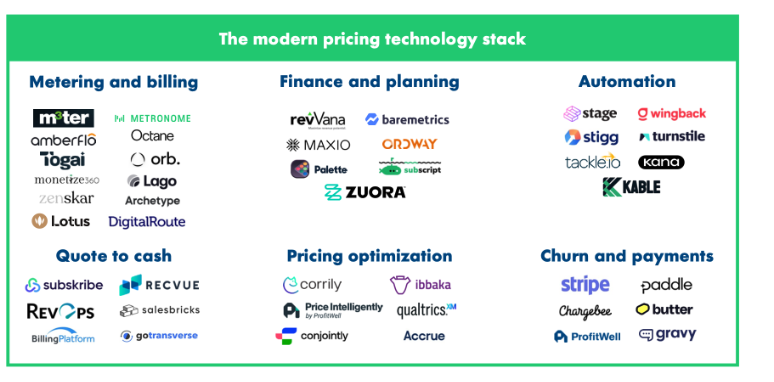

As pricing gets more complex, businesses have needed new tools to support their new models. As a result, we’ve seen a whole new class of SaaS products emerge as solutions for usage-based pricing-related needs.

This is great news for SaaS companies looking to change or experiment with their pricing—they won’t have to do it alone. There are no shortage of options for software tools to help with metering and billing, automation, pricing optimization, and more. Companies that embrace a modern pricing tech stack can ease their transition to UBP and build a comprehensive pricing system unique to their needs.

Stories of Scaling with Usage-Based Pricing

The Usage-Based Pricing Playbook

State of Usage-Based Pricing Report: 2nd Edition

What’s the state of pricing in 2023? Data from our 2023 SaaS Benchmarks report uncovers a few key trends to know heading into the new year. Read the full analysis here.

There are many stops and starts on the road to IPO. Here’s a collection of our top advice from more than 10 years of archived content.

When it comes to pricing, the best lessons come from mistakes made by others, not firsthand. Discover what you can learn from the Netflix pricing strategy ups and downs.

Software buying has evolved. Has your pricing? Why usage-based pricing is beating out other SaaS pricing models.

Usage-based pricing is a hot trend, but does it deliver? The answer—according to our recent study—appears to be yes.